stock options tax calculator usa

The wage base is 142800 in 2021 and 147000 in 2022. Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in.

Taxes On Equity Compensation The Holloway Guide To Equity Compensation

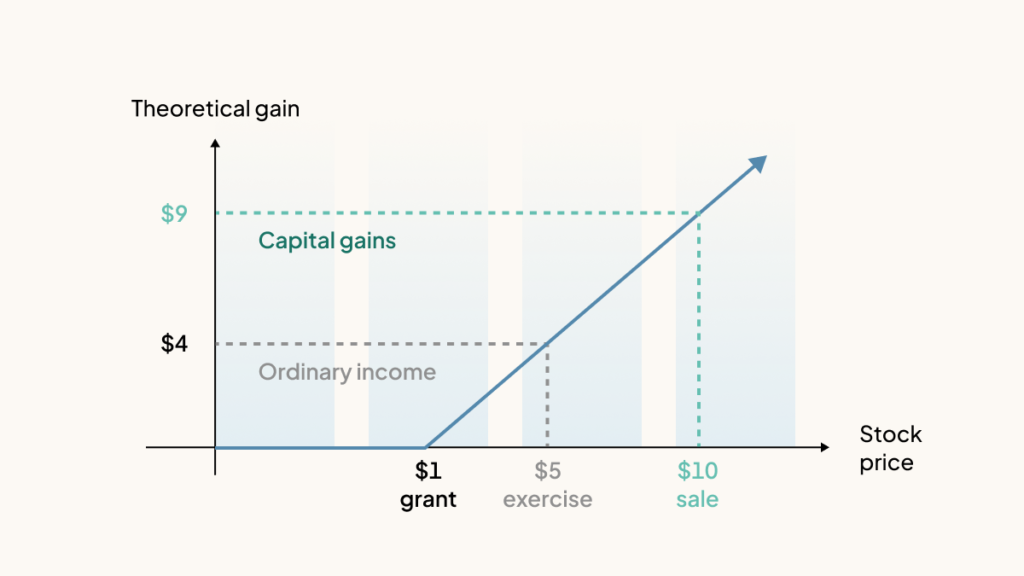

When you exercise the option you include in income the fair market value of the stock at the time you acquired it less any amount you paid for the stock.

. Non Qualified Stock Options Calculator. This calculator illustrates the tax benefits of exercising your stock options before IPO. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two.

Ordinary income tax and capital gains tax. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net. Refer to Publication 525 for specific details on the type of stock option as well as rules for when income is reported and how income is reported for income tax purposes.

How much are your stock options worth. The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term capital gains compared with a maximum rate of 37. The tax rate on long-term capital gains is much lower than the tax rate on ordinary income a maximum rate of 20 on most long-term.

This permalink creates a unique url for this online calculator with your saved information. Click to follow the link and save it to your Favorites so. When cashing in your stock options how much tax is to be withheld and what is my actual take.

Using the united states tax calculator is fairly simple. 60 of the gain or loss is taxed at the long-term capital tax rates. Section 1256 options are always taxed as follows.

The Employee Stock Options Calculator For use with Non-Qualified Stock Option Plans. There are two types of taxes you need to keep in mind when exercising options. Please enter your option information below to see your potential savings.

Tax exemption on the first 2000 of gains and exemption of 25. In our continuing example your theoretical gain is. Your payroll taxes on gains from.

On this page is a non-qualified stock option or NSO calculator. 4 HI hospital insurance or Medicare is 145 on all earned income. Even taxpayers in the top income tax bracket pay long-term capital gains rates.

This is ordinary wage. This is an online and usually free calculator. Additionally your marital status also influences your tax rate.

On this page is an Incentive Stock Options or ISO calculator. Stock Options Tax Calculator Usa. The same property or stock if sold within a year will be taxed at your marginal.

Once youve opened it you need to provide the initial value at which the asset was bought the sale value at which you have sold it and the duration. 16000 - 15000 1000 taxable income. 40 of the gain or loss is taxed at the short-term capital tax.

Vesting us stock options while living outside of the us. Depending on your regular income tax bracket your tax rate for long-term capital gains could be as low as 0.

Doing Business In The United States Federal Tax Issues Pwc

Nso Or Non Qualified Stock Option Taxation Eqvista

Rsu Taxes Explained 4 Tax Strategies For 2022

Understanding The Tax Implications Of Stock Trading Ally

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

2021 2022 Capital Gains Tax Rates Calculator Nerdwallet

My Startup Stock Options Calculator Real Finance Guy

Non Qualified Stock Options Definition Examples Why Are They Used

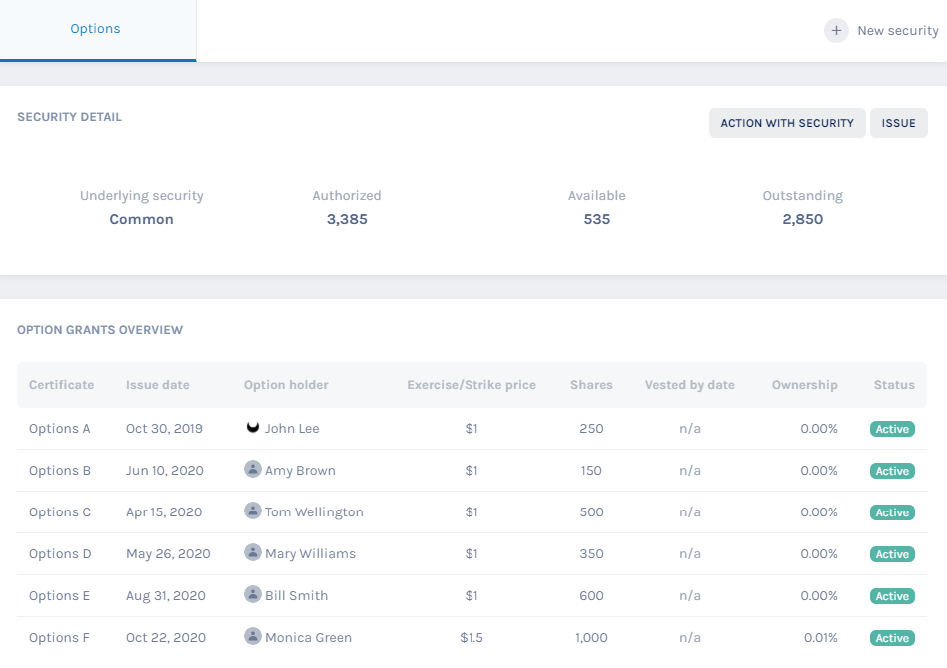

Secfi Stock Option Tax Calculator

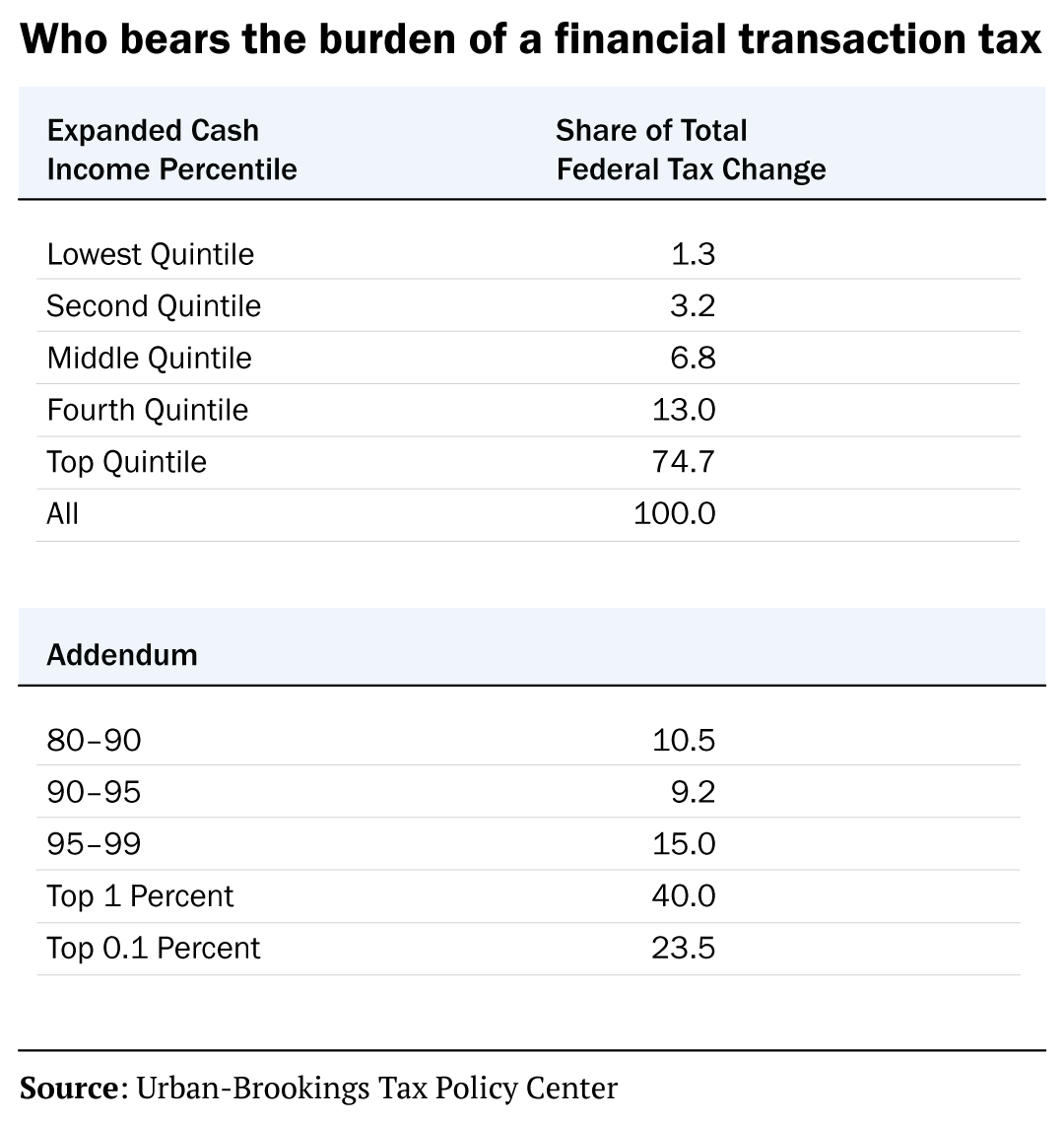

What Is A Financial Transaction Tax

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

How Are Stock Options Taxed Carta

1040 Income Tax Calculator Ameriprise Financial

How To Grant Stock Options To Foreign Employees